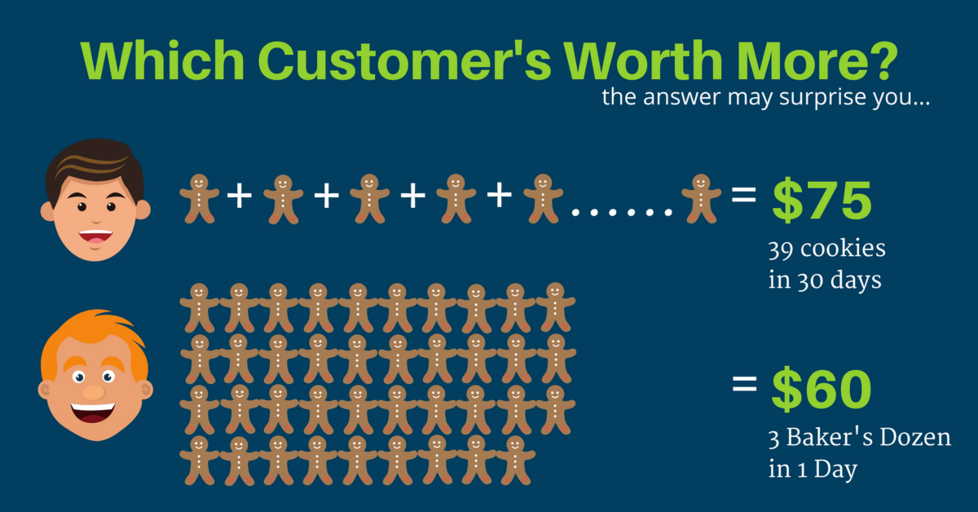

Over the course of 30 consecutive days, a man walks into a bakery and buys a cookie (or two). At the end of the 30 days, he’s purchased 39 cookies he’s spent $75. At the beginning of those same 30 days, a second man walks into the same bakery and buys 3 baker’s dozen. He spent $60.

Which customer is worth more to the bakery?

At first glance, some folks may point to the first man. Unfortunately, this quick answer doesn’t consider the entire picture. At a bare minimum, the bakery’s owner needs to factor in the cost of rent, electricity, and personnel.

Most likely, the second man’s single purchase earns the business more money. (We’re going to address this issue more thoroughly in bullet point 6.)

9 Sales Metrics to Track and Why

Why is a design and marketing firm talking about tracking sales? Because it matters. And, because we encounter far too many businesses owners who simply don’t know many of the sales metrics essential to growing their business.

You can throw money and resources at advertising, product development, and customer management all day. However, connect that investment to an actual profit, you’re simply shooting in the dark.

As we work with clients to promote their business and develop qualified leads, these are the following sales metrics on which we focus.

1. Total Sales by Period

Total sales (aka gross sales) is the total dollars your business has collected from customers. This is a stat all businesses are required to track by law – as it’s to file taxes. In the case of taxes, your business typically only need the total sales for the year. In the case of marketing and improving your bottom line, you’ll certainly want to look at your year-over-year total sales. But, you’ll most likely also want to consider your total sales on a monthly basis. Some industries also benefit from looking at sales on a daily or weekly basis.

Tracking sales by period allows you to evaluate performance.

In particular, tracking sales by month is important for businesses to determine performance. If you wait until the end of the year to see a dip in sales, it can be too late to recover.

However, monthly tracking allows you to identify potential issues – such as below average monthly sales – and make strategic changes to recover in the following months.

2. Total Sales of Individual Products and/or Services

Sometimes it’s easy to guestimate the which products are selling well and which aren’t. But even if it’s easy, it’s still a guess. Tracking the total sales of each individual product and/or service you provide allows you to know precisely what’s selling and what isn’t.

Use total product sales figures to determine viability and direct resources

Products and services have a lifespan. As technologies evolve and customers’ needs change, previously popular no longer hold their relevance. Depending on the item and the industry, lifespans can differ wildly.

The key is to identify when the lifespan has started to run out or has run out completely. Once a lifespan has run its course, the viability of an item as a money generator plummets. You no longer want to keep investing time and resources into it. Rather you want to focus on finding new products and services your customers need. Furthermore, tracking total sales of individual items can help you determine the effectiveness of your marketing campaigns. For example, if you do a large online push for an upcoming concert and you see a large spike in sales – there’s most likely a correlation between the two.

3. Revenue Per Sale

Your revenue per sale refers to the amount a customer spends on any one transaction. Even a small increase in your average revenue per sale can deliver substantial growth in your bottom line.

Identify opportunities to ‘upsell’ customers at the point of purchase.

The best time to upsell a customer is when they’ve already made the decision to purchase. They are more likely to add a less expensive feature to upgrade their product or service.

Fast food restaurants do this by asking if you want to add a drink. Retail stores place a variety of small, often indulgent items near the checkout counter to encourage impulse buys.

Travel companies may recommend a tour at your destination. Concert venues may provide a discount for buying a block of tickets. These upsells aren’t gargantuan expenditures for the customer, but they could be big money makers for you.

4. Percentage of Sales New vs. Returning Customers

For most businesses, attracting new customers costs substantially more than selling to a returning customer. By tracking the percentage of sales your business makes to new versus returning customers, you can determine your retention rate.

Boost returning customer sales percentage by focusing on relationship building.

Marketing strategies, like an email newsletter, can help your business maintain contact with previous customers – encouraging repeat business. Your business may also benefit from recognizing their birthday, celebrating the anniversary of their first purchase or alerting them of an update to a product they’d previously bought.

5. Sales by Point of Purchase

Point of purchase (POP) refers to where customers made their purchases – also known as the location. In most instances, a business’ POPs can be broken down into three categories:

Web

Phone

In-Store

Make sure your top performing POP location is optimized for maximum user experience.

User experience at POP plays a significant role in both conversion rates and repeat business. The harder it is to actually buy the product or service, the more likely a potential customer is to abandon the process.

6. Cost Per Acquisition

Cost per acquisition (CPA) is the average amount your business must spend to secure a new customer. Prior to the digital age, determining this figure was a bit of a shot in the dark. However, the more analytics have improved, the more accurately we are able to track the true sales funnel of a customer.

CPA Helps You Determine When Your Business Will Begin Seeing a Profit

Knowing your cost per acquisition can help you determine everything from product price point to advertising budget. Because…If you spend $20 to get a customer to spend $10, your business lost money. However, if that same customer returns three more times, spending $10 each time, your businesses has seen a 100% return on investment (ROI).

7. Cost Per Conversion

Cost per conversion refers to how much your business has to spend before a customer makes a purchase. The smaller the cost per conversion, the more money your business makes.

For instance, if you sell concert tickets for $20 a ticket and your cost per conversion is $5, you make $15 on every purchase. Factors that can impact your cost per conversion can include, but are not limited to:

Facility Maintenance

Facility Operations (electricity, water, garbage, sewage, internet)

Staff (general salary, onboarding, healthcare, and benefits)

Marketing (website, social media participation, mailers, email campaigns, web advertising)

Office Supplies

Product Development

Product Shipping

Quality Control

Product Storage

Relationship Management

Licensing

Look for opportunities to reduce cost per conversion without reducing conversion rates.

Ideally, you’ll want to spend less and sell more. However, if you can spend less and sell the same, your business will still be money ahead. We always recommend looking at your cost per conversion and trying to identify areas which could be optimized.

However, optimization should be done with a delicate hand. Lowering your heat by two degrees may help you save on electricity. But if a cooler work environment keeps customers from visiting or reduces employee productivity, this can cost you more than you stand to save. Not to mention the devastating effects it can have on employee morale.

8. Sales by Lead Source

A lead source is an activity that directs potential customers to your business. This can feel like a bit of a grey area, because customer conversion is rarely a straight line. It’s not always possible to identify the exact lead source.

Why? Because individuals often need multiple touches before they make a decision. And, the bigger the purchase, the more touches it typically takes. However, this doesn’t mean you shouldn’t attempt to track lead sources. It means your business needs to get smarter about how they are tracking them. Lead sources include, but are not limited to:

Personal referrals from satisfied customers

Partner referrals from other businesses

Facebook advertising

Google Pay-Per-Click (PPC) advertising

Organic search

Billboards

Email newsletters

Inbound links to your website from external sites, such as influencers

Focus your marketing efforts on your top producing lead sources.

Focusing the majority of your marketing resources on the highest performing lead sources will typically deliver the best return on investment (ROI) for your business. If you are taking orders over the phone, requiring employees to ask how the customer heard about you.

If you made an online sale, you might consider following up with a short questionnaire. Placed an ad on a billboard or in a magazine, you might use a custom phone number or landing page on your website to track those sales specifically.

Tracking online sales? Create custom coded inbound links so you can track where the traffic originated.

9. Customer Lifetime Value

As the name would suggest, ‘customer lifetime value’ (CLV) defines the total amount your business can expect to make off the average customer while they remain a customer. The figure is determined by a variety of factors such as average customer lifespan, average customer retention rate, and profit margin.

Use Your CLV to Better Allocate Resources and Increase Profit

Understanding your CLV can help you determine which customers are more profitable. This allows you to focus on growing that specific demographic. Furthermore, it’s a good idea to look at the customer experience for those individuals who fall below the average. Are these individuals are encountering the same or similar pain points. Improving their experience can often improve your customer retention rate and your CLV.

Let’s Talk About How to Start Tracking Your Sales

Additional Reading

The 411 On Email Analytics and Goal Setting

Setting goals with targeted “Thank You” pages and consistent monitoring lets you see what works and what doesn’t.

What is a Manual Actions Report and How to Recover From One

A Manual Actions report is issued when Google determines your site is not compliant with their best practices. Don’t fret. Updates can be made.

Small Tweaks with Big Impacts: How to Increase Session Duration on Your Blog Posts

In essence, a session duration is like a coffee date with a friend. The better and more interesting the conversation – the longer the date.